What is considered short term on balance sheet?

Short term liabilities are also known as current liabilities, these are firm's financial obligations that a company has to pay to it's creditors within one financial year. Shorth term liabilities comes under the total liabilities section in the balance sheet.

Short-term debt is defined as debt obligations that are due to be paid either within the next 12-month period or the current fiscal year of a business. Short-term debts are also referred to as current liabilities. They can be seen in the liabilities portion of a company's balance sheet.

Balance sheet ratios include liquidity ratios (measuring the company's ability to meet its short-term obligations) and solvency ratios (measuring the company's ability to meet long-term and other obligations).

Short-term investments, also known as marketable securities or temporary investments, are financial investments that can easily be converted to cash, typically within 5 years. Short-term investments can also refer to the holdings a company owns but intends to sell within a year.

The examples of Short-term Provisions are Provision for discount on debtors, Provision for tax, doubtful debts etc. The examples of Long-term Provisions are Provision for renewals and repairs, Provision for depreciation.

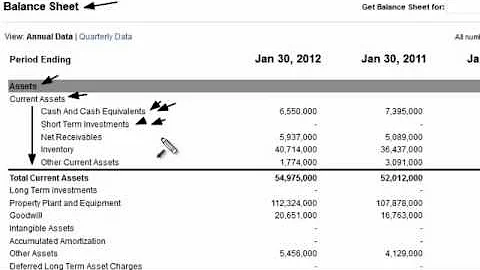

Current assets, such as cash, accounts receivable and short-term investments, are listed first on the left-hand side and then totaled, followed by fixed assets, such as building and equipment.

A credit card is basically a short-term loan. Unlike debit cards, which take your money directly out of your bank account, credit cards allow you to borrow money to pay for goods or services.

Short term loan and advances

Explanation: Short term loans and advances represent funds lent by a company to other parties or advances made for a short duration, typically less than one year, and are classified as current assets on the balance sheet.

How To Calculate Current Liabilities. To calculate current liabilities, you need to add up the money you owe lenders within the next year (within 12 months or less) or within the business' normal operating cycle. This may include current payments on long-term loans (like monthly mortgage payments) and client deposits.

Short-term assets refer to assets that are held for a year or less, with accountants using the term “current” to refer to an asset expected to be converted into cash in the next year. Both accounts receivable and inventory balances are current assets.

What is considered long-term debt on a balance sheet?

Long-term debt is listed under long-term liabilities on a company's balance sheet. Financial obligations that have a repayment period of greater than one year are considered long-term debt.

A balance sheet reflects the company's position by showing what the company owes and what it owns. You can learn this by looking at the different accounts and their values under assets and liabilities. You can also see that the assets and liabilities are further classified into smaller categories of accounts.

Examples of short-term investments include CDs, money market accounts, high-yield savings accounts, government bonds and Treasury bills. These investments are typically high-quality and highly liquid assets or investment vehicles.

In the case of assets, a short term can refer to holding an asset for less than or equal to one year. In the case of current assets of a business, such as inventory or bills receivable, the short term period may be within six months.

Short-Term Investments on the Balance Sheet

Short-term investments are disclosed as part of a company's current assets on its balance sheet. This is done in a separate account and the accounting of these investments is treated on the assumption that they will mature within one year.

Short-term debt, also called current liabilities, is a firm's financial obligations that are expected to be paid off within a year. Common types of short-term debt include short-term bank loans, accounts payable, wages, lease payments, and income taxes payable.

Long-term liabilities are typically due more than a year in the future. Examples of long-term liabilities include mortgage loans, bonds payable, and other long-term leases or loans, except the portion due in the current year. Short-term liabilities are due within the current year.

Reporting these investments on the balance sheet depends on management's intent. If the investment is intended to be temporary, it is categorized as a current asset. If it intended to be long-term, it is a noncurrent asset.

Non-current assets (definition)

Non-current assets commonly include: long-term investments such as such as bonds and shares. fixed assets such as property, plant and equipment. intangible assets such as copyrights and patents.

Current assets include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, pre-paid liabilities, and other liquid assets. The Current Assets account is important because it demonstrates a company's short-term liquidity and ability to pay its short-term obligations.

What is short-term provision in a balance sheet?

Provision is created to meet the liability of the company. By short term provisions we mean that the provision is created to meet the short obligations/payments. Hence, short term provisions will appear in current liabilities and not in Non-current Liabilities.

Short-term assets typically include cash, accounts receivable, inventory, and marketable securities. They are listed on the balance sheet under current assets. Short-term assets are critical for a company's day-to-day operations and financial health.

It appears under liabilities on the balance sheet. Credit card debt is a current liability, which means businesses must pay it within a normal operating cycle, (typically less than 12 months).

Also known as short-term liabilities, short-term debt refers to any financial obligations that are due within a 12-month period, or within the current business year or operating cycle. Some common examples of short-term debt include: Short-term bank loans.

Notes payable are long-term liabilities that indicate the money a company owes its financiers—banks and other financial institutions as well as other sources of funds such as friends and family. They are long-term because they are payable beyond 12 months, though usually within five years.