Does petty cash go under cash and cash equivalents?

However, on corporate financial statements, petty cash is listed in the "Cash and cash equivalents" section of the balance sheet.

Cash and cash equivalents refers to the line item on the balance sheet that reports the value of a company's assets that are cash or can be converted into cash immediately. Cash equivalents include bank accounts and some types of marketable securities such as commercial paper and short-term government bonds.

Petty cash falls under the head of current assets in the balance sheet. This is on the grounds the assets that are yet to be determined on the sheet are arranged in their order of liquidity. Petty cash being exceptionally liquid, it shows up close to the highest point of the balance sheet.

Petty cash is a current asset and should be listed as a debit on the balance sheet. When first funding a petty cash account, the accountant should write a check made out to "Petty Cash" for the desired amount of petty cash and then cash the check at the company's bank.

The petty cash fund goes through periodic reconciliations, and these transactions are also recorded in financial statements. In enterprises, each department may have its petty cash fund allocated. The petty cash balance sheet is also classified under current assets in the balance sheet due to its high liquidity.

Is Petty Cash a Cash Equivalent? No. Petty cash is actual cash money: bills and coins. Cash equivalents are highly liquid securities and other assets that can be easily converted into cash: money market funds, commercial paper, or short-term debt, like Treasury bills.

Cash and equivalents do not include investments in liquid securities like bonds, stocks, and derivatives. Even though such assets can be quickly converted to cash (usually within three days), they are nonetheless excluded. On the balance sheet, the assets are classified as investments.

In most cases, corporations should set up a petty cash fund to manage such spending. The best practice is establishing a proper system – known as petty cash management – to record these expenditures appropriately. Since petty cash is a current asset, it is considered a debit on the firm's balance sheet.

For petty cash accounting, you must create a log detailing your transactions. And, you must record a petty cash journal entry when you put money into the petty cash fund and when money leaves the fund. Consider recording petty cash transactions in your books at least once per month.

Enter Petty cash for the Category name. Select Select category, then select Bank & credit cards.

What are the GAAP rules for petty cash?

Location and Designated Staff

The GAAP rules recommend that petty cash funds are kept in a locked location, such as a cash box or drawer, with documentation of transactions. Businesses should designate a custodian of the petty cash fund and designate a different person to authorize or approve disbursem*nt of the funds.

Petty cash appears on the balance sheet under the “Current Assets” section, usually as a separate line item. It is considered a highly liquid asset because it is cash or cash equivalents.

Petty cash appears within the current assets section of the balance sheet. This is because line items in the balance sheet are sorted in their order of liquidity. Since petty cash is highly liquid, it appears near the top of the balance sheet.

The petty cash account is a current asset and is recorded as a debit in the balance sheet.

- Petty Cash Journal Entries At A Glance.

- Step 1: Establish Petty Cash Policies & Procedures.

- Step 2: Transfer Cash to a Lockbox.

- Step 3: Reimburse Receipts and Record Expense in the Petty Cash Log.

- Step 4: Reconcile Petty Cash Regularly.

- Step 5: Complete the Bottom Portion of the Petty Cash Log.

- Step 1: Ascertain fund balance. Start by counting the balance left over in your petty cash fund box or drawer. ...

- Step 2: Confirm documentation proofs. ...

- Step 3: Categorize and add withdrawals. ...

- Step 4: Check for 'Cash Over' or 'Cash Short' ...

- Step 5: Restore original balance. ...

- Step 6: Reconcile payments.

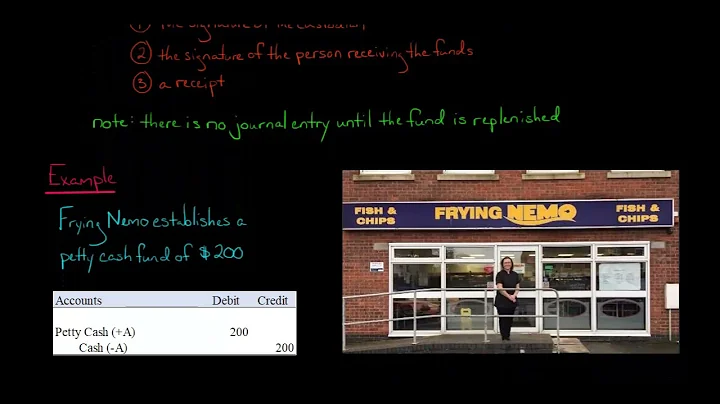

What type of account is petty cash? Petty cash is a current asset listed as a debit on the balance sheet. An accountant will typically write a cheque to "Petty Cash" to fund the petty cash account and cash this cheque at the company's bank.

Identify cash and cash equivalents: Look for the items on the balance sheet that qualify as cash and cash equivalents. These may include items like cash on hand, cash in checking or savings accounts, and short-term investments, including market funds or Treasury bills.

Here are the different types of petty cash: General Petty Cash: Money that is set aside for small, miscellaneous expenses that is typically used for office supplies, postage, and minor employee reimbursem*nts. Imprest Petty Cash: It is the money that is periodically replenished.

Cash includes legal tender, bills, coins, checks received but not deposited, and checking and savings accounts. Cash equivalents are any short-term investment securities with maturity periods of 90 days or less.

What would be included in cash equivalent?

Cash equivalents include U.S. government Treasury bills, bank certificates of deposit, bankers' acceptances, corporate commercial paper, and other money market instruments. These financial instruments often have short maturities, highly liquid markets, and low risk.

Examples of items commonly considered to be cash equivalents are Treasury bills, commercial paper, money market funds, and federal funds sold (for an entity with banking operations). The definition presumes that all cash equivalents have two attributes: they must be (1) short-term and (2) highly liquid.

All Petty Cash Funds must be stored in a secured device such as a safe or cash box in a locked cabinet. Only the Petty Cash Fund custodian should have keys to the box and cabinet. Funds should never be left unattended and unsecured. Funds within a box need to be locked and behind locked doors when not attended.

Petty cash is a nominal sum which is preserved in hand to cover minor expenses, such as reimbursem*nts or other office-related expenses. Like other funds, petty cash will also be subject to regular reconciliations, with every transaction being recorded in the official statements and other records.

Petty cash refers to cash set aside for small purchases. Cash on hand includes all of a business's cash and liquid assets including cash in cash registers and bank accounts. See related terms. Chart of accounts. Balance sheet.