Do you want to save more money each month, such as saving half your income? What would having that extra savings mean for you?

Would you be able to pay off debt faster? Save for a down payment on a home? Take that vacation you’ve been dreaming about?

I recently read an article that said 65% of Americans save little or nothing. Only 16% of survey respondents said that they save more than 15% of what they make, which many financial experts generally recommend.

Just a few years ago, I use to struggle with saving money because I was an overspender. But once my boyfriend and I started talking about going back to school (which we did), getting married (which we’re planning now) and making other big plans for our future, I realized that I needed to learn how to save most of my paycheck.

I knew that ONLY I was responsible for myself and how I managed my money. There was no Knight in shining armor coming to rescue me from my overspending behavior or a fairy godmother waving her wand to make my bank account magically grow bigger. It was up to ME to improve my spending habits and increase my income so I could reach my goals.

Before I dive into everything, I want to say that these are not earth-shattering tips and tricks. We went from entry-level jobs to finding ways to grow our income over the years, while avoiding the temptation to give into lifestyle inflation. That’s why we challenged ourselves to live on half our income.

No, it wasn’t easy and there was no straight path to get to this point. But that’s exactly what continued to motivate us to cut down our monthly expenses so we could save more money. We understand that life doesn’t always go the way we planned. Sometimes job loss can happen or living expenses can suddenly increase.

With that in mind, we’ve focused on shifting our mindset to make saving half our income possible.

No matter what your income level or goal is, maximizing your savings is possible. And the more money you save, the more options and freedom you’ll have in the long run. Here are a few ways you can make this happen:

- Option #1: Decrease monthly expenses + Income stays the same

- Option #2: Monthly expenses stay the same + Increase income level

- Option #3: Decrease monthly expenses + Increase income level

In the beginning, we tried to save money by decreasing our monthly expenses while our income stayed at the same level. However, this was challenging because the cost of living was increasing in Toronto and it felt like we were constantly depriving ourselves. We also had a scarcity mindset at the time (thinking that we were missing out on everything and that it was impossible to save enough money).

Once we developed an abundance mindset (that there is more than enough for everyone), we were motivated to find ways to grow our income while cutting back on unnecessary expenses. Here’s how we save 50% of our income and how you can start saving half your income too!

Related Posts:

- How to save money with sinking funds

- 50 creative ways to save money on a tight budget

- 10 silly budgeting mistakes and how to avoid them

Table of Contents

Track your spending

If you want to get on the right track toward saving half your income, the first step is to track your spending. This will help you get a better understanding of where your hard-earned cash is going.

If this is your first time tracking your spending, I recommend looking at your past bank statements or tracking your spending for the next 30 days. Before you can start making changes to your spending, it’s important to get a clear picture of what your current spending habits are.

You can use a pen and paper to do this or a fancy spreadsheet. I personally like to use my Tracking Expenses worksheet to help me to do this. It allows me to easily organize each expense by category, which is great if you want to determine which areas you can trim your spending.

Read Next: 5 things to do before creating a budget

Do a no spend challenge for 30 days

Once you’ve tracked your spending for 30 days, I highly recommend doing a no-spend challenge for one month. This means limiting your spending to ONLY the essentials, such as rent / mortgage, transportation, gas, groceries, and so on. This is an easy way to start saving half your income.

You can set the rules for your no-spend month, just make sure that you’re giving an honest effort to not spend money on non-essentials (dining out, daily lattes, nail salon visits, shopping, drinks out with friends, expensive workout classes, and so on).

Read Next: 8 Rules for a Successful Shopping Ban

This challenge will definitely test your willpower and some days won’t be easy. The goal isn’t to be perfect and it’s natural to have a few days where you may slip.

The whole point of doing this challenge is to help you determine what discretionary (non-essential) spending is truly important to you. It’ll also help you figure out what expenses can be reduced or even eliminated.

For example, when I first did my first no-spend month, I thought I couldn’t live without my daily trip to the coffee shop. But it was surprisingly easy to resist.

I bought new coffee beans, which I grind fresh each morning (it only added an extra 30 second to my routine), and I was able brew my own coffee at home. Now I prep everything the night before, so I have no excuse but to enjoy fresh hot coffee in the morning. This is the coffee maker I use. It’s affordable and much easier to clean than a traditional drip coffee machine.

I also thought it would be impossible to give up shopping for a month. If you’re new to my blog, I used to be a shopaholic and struggled with saving money (due to my compulsive buying behavior). This was actually the reason why I decided to do a no-spend month in the first place, because I needed to get control of my shopping triggers. I ended up extending my no-spend month to a no-spend year for clothes. You can ready about my experience here.

I did learn that dining out on the weekends is important to me and worth spending money on. While I eat at home for all my meals during the week, I do like to have a night off from cooking and enjoy going out on the weekends.

It’s important to recognize what expenses are worth the cost to you and which ones you can reduce or eliminate. You may not need to do a complete no-spend month to figure this out, but this worked for me.

During this time, I realized that I could save money by reducing my visits to the coffee shop (because it’s not super important to me) and budget for dining out on the weekends (because this is important to me).

Make a clear plan for your money

Once you’ve finished tracking your expenses and doing a no-spend month, it’s time to make a clear plan for your money. This can help you get closer to saving half your income. Whether you want to build an emergency fund, pay off debt, save for a wedding or a down payment on a home, or to retire early, having a clear plan for your money will make it easier to save.

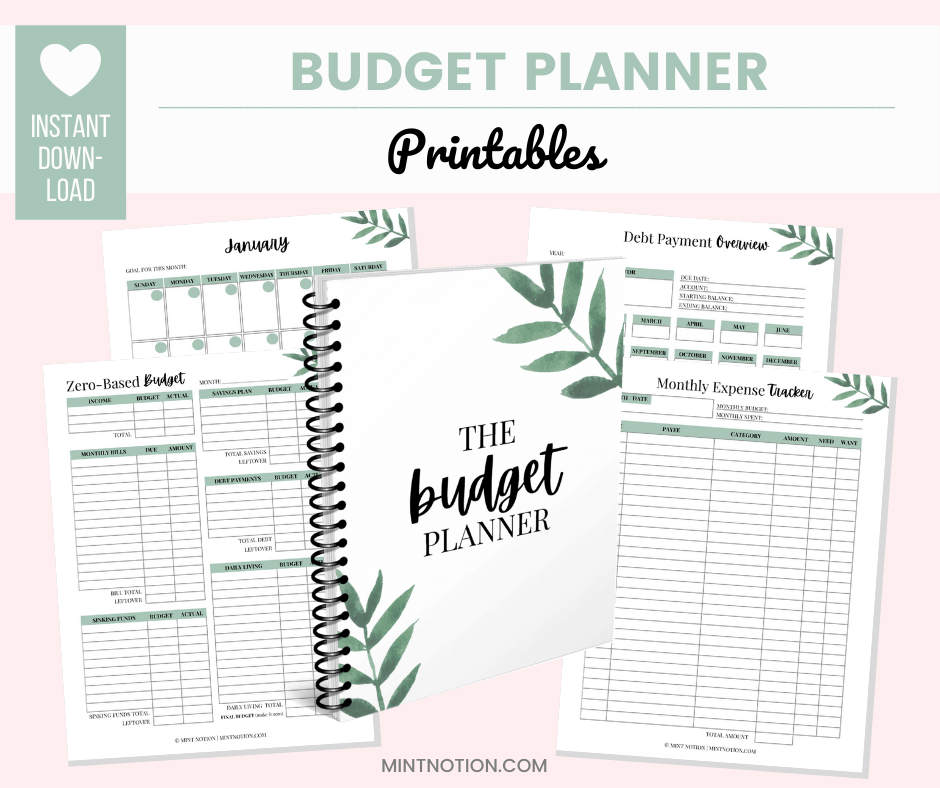

Our big goals right now are to save money for our wedding and to eventually purchase our dream home. When creating our monthly budget, we always keep these goals in mind. You can use an app to create your budget or a spreadsheet. I like to use these printable worksheets to organize my finances.

Read Next: How to make a zero-based budget

Reduce your biggest expenses

For most people, their biggest expenses include housing (rent or mortgage), transportation, and food (groceries and dining out). Finding ways to reduce these expenses is a good place to start if you’re interested in saving half your income.

While financial experts recommend spending no more than 30% of your monthly gross income on housing, this is becoming more difficult to achieve with today’s stagnant wages and soaring housing prices in big cities.

How we save money on housing

For us, we live in a condo which my boyfriend bought several years ago. It was in the low $400,000 price range. He bought this condo when it was for sale during pre-construction. This helped him save a lot of money when buying his first home.

Here are some ways that can help reduce housing costs:

- Live at home with family.

This is not always possible, but it can be a great way to reduce or eliminate housing costs temporarily. For the first time in more than 130 years, Americans ages 18-34 are more likely to live with their parents than any other living situation. I was very fortunate to have parents who lived in the city where I was attending school. This allowed me to live at home during college and save money before I moved out into my own place. - Live with friends / get a roommate.

Even if you’re married or have a family, you may want to consider renting out a spare bedroom. Some of my relatives did this for a few years. They rented out their spare bedroom to a student, which helped them reduce their housing expenses. - Consider alternative locations.

Many people want to live in big cities. However, the average rental price per square foot is often higher than it would be to live in a neighboring city. For example, many people who grew up living in Toronto have decided to move to small towns just outside of the city to slash their housing costs. They commute into the city for work or have found good jobs outside of the city. When deciding where to live, consider which qualities are most important to you and where you may be willing to compromise.

Housing is our biggest expense, however we do look for ways to live modestly. Here are some ways we save money around the home:

- We only upgrade things when needed. For example, our TV is 8 years old. It’s not a Smart TV, but I bought a Chromecast so we could stream movies.

- We don’t have cable. We cut cable almost two years ago and have no regrets.

- We don’t have a home phone. I think most people have gotten rid of their home phones today and just use their cell phone as their main number. We both have affordable cell phone plans. I only pay $25 per month for my cell phone for unlimited talk and text nationwide. I don’t have a data plan because we pay for unlimited high-speed internet at home (and I work from home). Mint Mobile is a good option for cheap phone plans.

- We don’t have expensive furniture. When we moved into our condo, we didn’t have any furniture. We bought most of our stuff from IKEA to save money and take good care of the items so they can last longer. Our small appliances and dishware are all from Costco.

- We have minimal home decor. I try to keep everything in our home functional. This means I try to avoid buying home decor. We don’t have any art or photos on the wall. I only have a few select holiday decor items that I like to put up seasonally.

- We do laundry during non-peak hours. For us, it’s cheapest to do laundry in the evening and on the weekends. I buy our laundry detergent from Costco to save money and use dryer balls instead of dryer sheets. I also make all my own cleaning supplies to reduce the use of harsh chemicals in the home.

How we save money on transportation

I am fortunate enough to work from home, so this helps me save a lot of money on transportation costs. When I do need to commute somewhere, I use public transit in the city. This is usually the cheapest and quickest option to get around town. I don’t drive or have my own car at this time.

My boyfriend has a company vehicle and car allowance through his work. He is on the road a lot, so the company covers his transportation costs. This is another way we save money on transportation. He also has a personal car which is 9 years old and has been fully paid off.

How we save money on food

Food is one expense that I struggled for years to reduce. This is because I used to hate cooking and preferred to eat out all the time.

It wasn’t until I watched a documentary about food (Forks Over Knives), that I started to become more interested in taking care of my health. This inspired me to learn how to create healthy meals at home instead of eating processed or high sodium foods at restaurants.

For the past few years, I’ve been watching cooking videos on YouTube and borrowing cookbooks from the library to teach myself how to make food at home. This has helped me save a lot of money and improved my health too. You may want to consider trying $5 Meal Plan, which is an affordable option for planning quick and easy meals.

We spend approximately $200-$250 on groceries each month for two people. We try to stick to a plant-based diet, which helps us save money and makes us feel good too.

We also spend around $100 per month at Costco. This is for bulk items (beans, frozen fruit, rice, quinoa, protein powder) and household supplies (toilet paper, paper towels, dish soap, laundry detergent). Here are some ways we save on our grocery budget:

- Meal plan.

Each week, I create a meal plan. This takes about 10-15 minutes to do. This helps save money and reduce food waste because I only purchase items that I know we’ll use that week. - Shop the flyers.

When planning my meals for the week, I always check to see what’s on sale at my local grocery store. 99.9% of the time, I ONLY buy what’s on sale that given week. If an item isn’t on sale, I don’t buy it. I am very lucky to live within walking distance to 3 grocery stores, so I can shop around for the best prices. I like using these printable worksheets to write down my weekly grocery list. - Buy staple items in bulk.

We try to always buy staple items in bulk (usually from Costco). These are items that have a long shelf life and I know that we’ll use up.

On the weekends, we do like to eat out. We make sure to include restaurants in our monthly budget because this is something we enjoy doing. On average, we spend about $50 a week eating out. This includes coffee shops, going for drinks, or dining at a restaurant.

Cut down on things that are not important to you

All in all, we live pretty simple lives and don’t need much to make us happy. We don’t go for fancy brunches on the weekends, we don’t go to clubs or parties, we don’t have the latest tech gadgets or wear trendy clothes, we don’t have new cars, we don’t have expensive hobbies, and we don’t have pricey gym memberships (we go to the free gym in our condo because it’s included in our condo fees).

We know what’s important to us and what we enjoy spending money on. This has helped us reduce or eliminate our spending on things that we don’t really care about. For example, I used to care A LOT about what clothes I wore. I was always buying the latest fashion trends and trying to “stay on top”.

But since overcoming my shopping addiction, I now prefer to invest in items that are timeless and won’t go out of style quickly. This helps us save half our income and I also get better mileage from my wardrobe.

Read next: How to shop your wardrobe and wear everything in your closet

I don’t believe there are right and wrong things to spend your money on. If you enjoy going to Starbucks everyday and can afford to do so (while still having enough money to set aside for savings and goals), then go ahead. No one should judge or make you feel bad for your spending choices.

I recommend making a list of things that are important to you and you enjoy spending money on.

Then make a list of things that are less important to you and areas where you can reduce your spending.

For example, going the nail salon is not very important to me, so I rarely go and prefer to paint my own nails at home. However, following a good skincare regime is important to me, so I am happy to spend more money on quality skincare products.

When you know your values and what’s truly important to you, it’s easier to reduce your spending on things that don’t align with your goals. This can help you get closer to saving half your income and budget for what really matters to you.

Read next: 10 silly budgeting mistakes and how to avoid them

In case you’re curious to know what we like to spend money on, here are our discretionary expenses:

- Spotify subscription – $13 per month.

- Home internet – $100 per month. Some people use data on their phones, but I don’t have a data plan. I use the WiFi at home for streaming movies, blogging, and so on.

- Cell phone – $25 per month for me. My boyfriend is on a family plan with his family. I think it costs around $55 per month for him.

- Haircut – $20 per month for my boyfriend. I cut my own hair at home for free.

- Hair color – $600-$1,000 per year. I get highlights in my hair 3-4 times per year and it costs around $300 each time.

- Travel – $2,000-$5,000 per year. We love traveling and spend the majority of our disposable income on this. (Since the pandemic started, we haven’t traveled anywhere).

- Dining out – $200-$250 per month. We enjoy going out to eat on the weekends. This includes weekend coffee shop visits or drinks on the patio in the summer.

- Shopping – $600-$1,200 per year. We don’t go shopping often and usually only buy new clothes or shoes when needed. Some months we don’t spend ANY money shopping. We usually make a list of things we need to buy and get everything when it’s on sale.

- Concerts – $150-$500+ per year. When our favorite bands are touring, we love to check them out in concert. Our concert spending varies A LOT each year, depending on which bands are touring. Some years we only go to 1 or 2 shows and some years we go to 5+ shows. (So far, I have only bought 2 concert tickets in 2019).

- Pet expenses – $40 per month. We have two cats.

- Business expenses – Some of my income goes toward paying taxes and running my online business. It’s not free to run this blog.

Boost your income

While you’ve probably heard stories about how people have managed to save large sums of money on a low income, theses stories are rare and difficult to replicate.

In the past, I focused only on saving money and pinching pennies, especially on those little expenses. But this extreme frugal lifestyle became exhausting and was not sustainable as the cost of living continued to rise where I live (Toronto).

Once I shifted my focus to finding ways to boost my income, my savings were able to rapidly grow. I am also thankful that some of my frugal habits stuck with me, because it taught me how to be content with less and manage lifestyle inflation. This means as my income grew, I was able to throw most of that extra money towards savings or reinvesting it back into growing my business.

There are many ways to boost your income. Whether it’s taking on more hours at your current job, negotiating a raise or applying for higher-paying jobs, there are lots of ways to earn more money. This can definitely make it easier to start saving half your income.

Other ideas include finding a second job, getting a side hustle or starting your own business.

At the end of the day, I always recommend building multiple streams of income. This is because you never want to put all your eggs in one basket. I have seen job loss happen in my family and it’s not easy.

If you were to lose your job tomorrow, do you have another source of income? It’s important to be prepared, especially in today’s economy.

Read Next: 42 ways to make $100 a day

Try to live on one income

When my boyfriend and I moved in together, we decided to live on one income. This is the simplest way to start saving half your income.

We both work and bring home money each month, but we wanted to challenge ourselves to try and live on one income. If you are a dual-income couple, living on one income is the easiest way to save more money.

We live primarily on my boyfriend’s income. We use my income to cover business expenses, my personal expenses (cell phone, hair salon appointments, and so on), and the rest goes into savings. Right now, we do not have a joint bank account. This is something that we’ll do once we get married.

At the end of each month, we have a “budget meeting”, which means we go over our spending for the past month and see how we can improve or make changes for the next month. We use my budget printables to help us reflect and plan our monthly budget.

The benefit of living on one income (or saving half your income) means that if you decide to become a one-income couple, such as one of you chooses to become a stay-at-home parent, you’ll be financially ready. It can also help prepare for emergencies, such as a job loss or pay cut.

Read Next: How to budget after an unexpected pay cut of job loss

Set up sinking funds

A sinking fund means you are setting aside money each month for a specific goal. This goal can be anything you want. It could mean saving money for Christmas, for a birthday, for a wedding, for a trip, to pay off debt, for a home, whatever you wish!

For example, if you want to save $1,000 to go on a trip in December and it’s September right now – this gives you around three months to save money. In order to reach your savings goal, you’ll need to save $330 every month until December.

A sinking fund is similar to a savings account, but the major difference is that a sinking fund is set aside for a specific goal. If you’re using one savings account to save for all your goals, it can be difficult to keep track of everything or you may be tempted to spend that money on something else.

I personally have two savings accounts: one for large planned purchases (such as vacations, our wedding, and our dream home) and one for unplanned expenses (having to get a new computer, car repairs, and so on).

Read Next: How to save money with sinking funds

I use my Monthly Savings Tracker worksheet included in my Budget Binder to keep track of my sinking funds. Here’s an example of how saving for sinking funds work. These are not our specific sinking funds, they are just an example for the purpose of this post.

$500 per month divided into five sinking fund categories:

- $150 for vacation

- $100 for a kitchen makeover

- $50 for Christmas

- $100 for work clothes

- $100 for home repairs

At the end of the year, your sinking funds will equal:

- $1,800 for vacation

- $1,200 for a kitchen makeover

- $600 for Christmas

- $1,200 for work clothes

- $1,200 for home repairs

If you want to take a vacation, you have the option to book a trip for $1,800 or you can continue to save money until your sinking fund reaches the amount needed for your dream vacation.

The whole point of having a sinking fund is to allow you plan and save money so you go on a vacation, give your kitchen a makeover, have a nice Christmas, buy new clothes for work, and be prepared for any home repair costs. You don’t have to worry about dipping into your emergency fund or going into debt to cover these expenses. This can help you start saving half your income to put towards your goals.

Recap

Here are 8 simple steps to saving 50% of your income:

- Track your spending

- Do a no-spend challenge for 30 days

- Make a clear plan for your money

- Reduce your biggest expenses

- Cut down on things that are not important to you

- Boost your income

- Try to live on one income

- Set up sinking funds

I hope you found this post helpful in learning how to start saving half your income. You can do this! I believe in you!

How to save half your income FAQs

Is it possible to save half your salary?

Yes, it’s possible to save half your salary. If you’re a dual-income couple, the quickest way to start saving half is to live on one person’s paycheck while saving the other.

You can choose to live on the higher of the two incomes. Then once you’ve adjusted to this new budget, you can transition to living on the lower of the two incomes.

If you’re living in a one-income household, then you try following the 50/30/20 budget rule. Instead of putting 50% of your income towards living essentials, choose to put 50% towards your savings. Then you can adjust the other half based on your needs and wants.

For example: 50% of your income towards your savings, 30% towards your needs, and 20% towards your wants.