A previous version of this story misstated the number of times the Nasdaq 100 advanced when the Magnificent Seven stocks fell. The story has been corrected.

Ho-ho-uh oh? As Tuesday’s CPI data and Wednesday’s Fed meeting hog this week’s limelight, something may be brewing in one hot corner of the stock market.

Monday marked the second time since 2012 that the Nasdaq 100 managed a positive close with all Magnificent Seven names — Apple AAPL, -0.41%, Amazon AMZN, -1.43%, Tesla TSLA, -3.10%, Nvidia NVDA, -4.35%, Microsoft MSFT, -0.31%, Meta META, -0.33% and Alphabet GOOGL, +0.43% — closing in the red.

It could be nothing. But our call of the day from The Macro Tourist’s Kevin Muir has an explanation as he warns selling of those heavyweights may just be getting started.

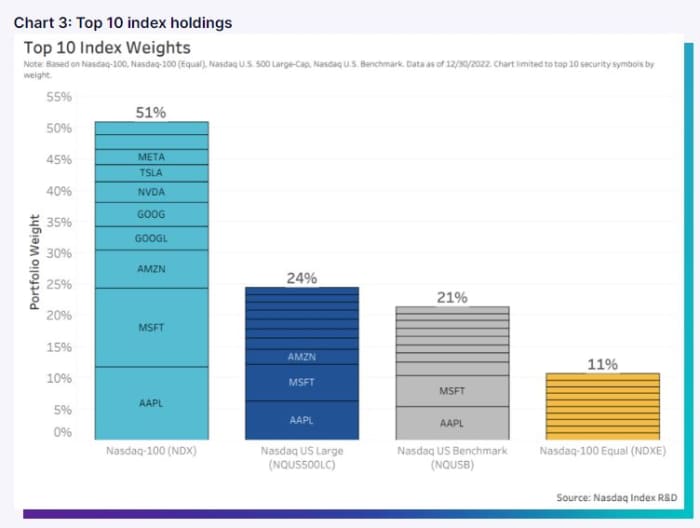

As Muir explains, the Nasdaq over the weekend announced final changes for its Nasdaq 100 rebalance or “Reconstitution” that will kick in with Friday’s option expiration. The committee had recently flagged the Magnificent 7 group’s heavy concentration and its methods of dealing with that, says Muir. Here’s a chart the Nasdaq used to display that:

Rebalancing by index committees is done quarterly to limit the influence of the biggest companies, but the Nasdaq did a “special rebalancing” this summer.

Muir flagged Barclays, which noted a “considerable surprise” from the rebalance, saying those big stocks saw “aggregate downweights translating to roughly -$13bn in supply, in contrast with the anticipation according to index methodology that those names would see meaningful ($17 billion previously projected to buy) upweights.”

Muir says Barclays laid out “monster” stock selling needed for rebalancing: Apple, $4.7 billion; Microsoft, $4.1 billion; Amazon, $2.26 billion; Alphabet A shares GOOGL, +0.43% $1.22 billion; Alphabet C shares GOOG, +0.31% $1.29 billion; Nvidia $1.76 billion and Meta $135 million. Tesla needs buying of $2.9 billion, but the bank notes $5.67 billion in buying was expected.

JPMorgan quants also noted the rebalancing, with figures that more or less matched the above. Money raised by selling those stocks must now go into buying the remaining 93 Nasdaq 100 names, Muir says.

So investment funds tracking those index changes would be forced to adjust their portfolios — hence Monday’s action.

“The selling of MAG7 to buy the rest of the Nasdaq-100 created one of the worst days of relative performance over the past couple of years,” said Muir.

Muir commended the Nasdaq committee for trimming the big names, and suggests selling could keep happening as other committees may follow suit in the new year.

“My guess is that this won’t be the end of the MAG7 selling and that we will look back at this point as the start of their return to being much more normal performing stocks,” said Muir.

The markets

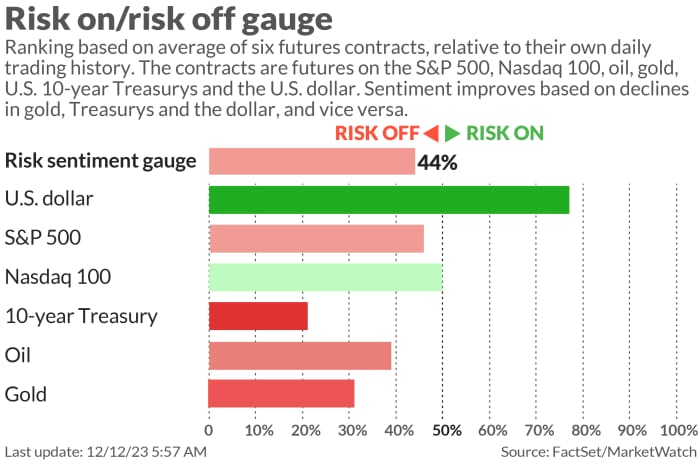

Stocks DJIA SPX COMP are now drifting lower post CPI, with Treasury yields BX:TMUBMUSD10Y BX:TMUBMUSD02Y steadying. Dollar DXY losses are holding, with the yen USDJPY, +0.02% grabbing back some of Monday’s lost ground. Gold GC00, -0.02% is now just above $2,001/oz. Oil prices CL.1, -0.48% BRN00, -0.46% are down over 2%.

The buzz

November inflation came in sticky, with headline CPI up 0.1%, above a forecast calling for no change, and core prices — minus food and energy — up 0.3%. Annually, core CPI was steady at 4%, and slowed to 3.1% as expected.

MarketWatch’s live blog: Fed rate cut expected in May, futures show

The federal budget is coming later.

AstraZeneca AZN, +1.20% will buy clinical-stage biopharmaceutical Icosavax ICVX, -0.91% for up to $1.1 billion. Icosavax shares are up 45% in premarket on the deal premium.

Hasbro HAS, -1.16% shares are down after saying 900 jobs will go due to weak toy sales. Mattel MAT, +0.47% is also off.

Oracle ORCL, -2.57% is down 9% after the software giant’s revenue disappointed, with data-center expansion plans looking risky.

Following AT&T’s T, -0.35% $14 billion contract snub, Nokia NOK, -1.69% NOKIA, +1.02% cut its 2026 margin outlook.

Shares of school bus provider Blue Bird BLBD, -5.91% are jumping after a profit surprise.

Ford F, -0.41% will reportedly halve production of its electric F-50 Lightning pickup trucks next year.

Best of the web

Shohei Ohtani reportedly will defer 97% of his annual MLB salary from his $700 million deal.

Crypto’s power vacuum after the trouble engulfing Sam Bankman-Fried and Changpeng Zhao.

Kyiv is running out of options to fund its fight against Russia

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

| TSLA, -3.10% | Tesla |

| GME, -4.46% | GameStop |

| NVDA, -4.35% | Nvidia |

| AMC, -3.52% | AMC Entertainment |

| AAPL, -0.41% | Apple |

| NIO, -2.93% | Nio |

| AMZN, -1.43% | Amazon |

| AMD, -4.70% | Advanced Micro Devices |

| META, -0.33% | Meta Platforms |

| MSFT, -0.31% | Microsoft |

Random reads

Nacho Cheese Doritos — drink up.

Lots of people unaware they earn less than this UPS driver.

Inside the World Excel Championships.

NFL quarterback Tommy DeVito and his agent are hot stuff.

Need to Know starts early and is updated until the opening bell, butsign up hereto get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.