StockBrokers.com is committed to the highest ethical standards and reviews services independently. Learn how we make money.

Home

Compare Stock Brokers

![]()

Written by StockBrokers.com

January 31, 2024

Is E*TRADE better than J.P. Morgan Self-Directed Investing? After testing 18 of the best online brokers, our analysis finds that E*TRADE (96.6%) is better than J.P. Morgan Self-Directed Investing (82.2%). E*TRADE is a top-performing broker whose highlights include $0 trades, two excellent mobile apps and the Power E*TRADE platform. Crypto, however, is not available.

Select Brokers

↓×

- check_box_outline_blankcheck_boxAlly Invest

- check_box_outline_blankcheck_boxCharles Schwab

- check_box_outline_blankcheck_boxCiti Self Invest

- check_box_outline_blankcheck_boxE*TRADE

- check_box_outline_blankcheck_boxeToro

- check_box_outline_blankcheck_boxFidelity

- check_box_outline_blankcheck_boxFirstrade

- check_box_outline_blankcheck_boxInteractive Brokers

- check_box_outline_blankcheck_boxJ.P. Morgan Self-Directed Investing

- check_box_outline_blankcheck_boxMerrill Edge

- check_box_outline_blankcheck_boxPublic.com

- check_box_outline_blankcheck_boxRobinhood

- check_box_outline_blankcheck_boxSoFi Invest

- check_box_outline_blankcheck_boxtastytrade

- check_box_outline_blankcheck_boxTD Ameritrade

- check_box_outline_blankcheck_boxTradeStation

- check_box_outline_blankcheck_boxTradier

- check_box_outline_blankcheck_boxVanguard

- check_box_outline_blankcheck_boxWebull

×

Open and fund & get up to $1,000.

Visit Site

×

Sponsored

navigate_beforenavigate_next

| Overall Rating | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Overall | |||

| Commissions & Fees | |||

| Investment Options | |||

| Platforms & Tools | |||

| Mobile Trading Apps | |||

| Research | |||

| Customer Service | N/A | ||

| Education | |||

| Ease Of Use | |||

| Winner | check_circle | ||

| Review | E*TRADE Review | J.P. Morgan Self-Directed Investing Review |

| Broker Screenshots | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Trading Platform & Tools Gallery (click to expand) | |||

| Research Gallery (click to expand) | |||

| Mobile Trading Apps Gallery (click to expand) | |||

| Education Gallery (click to expand) |

| Trading Fees | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Minimum Deposit | $0.00 | $0.00 | |

| Stock Trades | $0.00 | $0.00 | |

| Penny Stock Fees (OTC)info | $6.95 info | $0.00 | |

| Mutual Fund Trade Fee | $0.00 | $0 | |

| Options (Per Contract) | $0.65 | $0.65 | |

| Futures (Per Contract) | $1.50 | (Not offered) | |

| Broker Assisted Trade Fee | $25 | Varies |

| Margin Rates | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Margin Rate Under $25,000 | 14.2% info | 13.25% | |

| Margin Rate $25,000 to $49,999.99 | 13.7% | 13% | |

| Margin Rate $50,000 to $99,999.99 | 13.2% | 12.5% | |

| Margin Rate $100,000 to $249,999.99 | 12.7% | 12.25% | |

| Margin Rate $250,000 to $499,999.99 | 12.2% | 12.25% | |

| Margin Rate $500,000 to $999,999.99 | Varies info | 11.5% | |

| Margin Rate Above $1,000,000 | Varies info | 11% info |

| Account Fees | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| IRA Annual Fee | $0.00 | $0.00 | |

| IRA Closure Fee | $0.00 | $75.00 | |

| Account Transfer Out (Partial)info | $0.00 | $0.00 | |

| Account Transfer Out (Full)info | $75.00 | $75.00 | |

| Options Exercise Fee | $0.00 | $0.00 | |

| Options Assignment Fee | $0.00 | $0.00 |

| Investment Options | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Stock Tradinginfo | Yes | Yes | |

| Margin Trading | Yes | Yes info | |

| Fractional Sharesinfo | No | No | |

| OTC Stocksinfo | Yes | Yes | |

| Options Tradinginfo | Yes | Yes | |

| Complex Options Max Legsinfo | 4 | 1 | |

| Futures Tradinginfo | Yes | No | |

| Forex Tradinginfo | No | No | |

| Crypto Tradinginfo | No | No | |

| Crypto Trading - Total Coinsinfo | 0 | 0 | |

| Mutual Funds (No Load)info | 6486 | 3500 | |

| Mutual Funds (Total)info | 7242 | 3500 | |

| Bonds (US Treasury)info | Yes | Yes | |

| Bonds (Corporate)info | Yes | Yes | |

| Bonds (Municipal)info | Yes | Yes | |

| Traditional IRAsinfo | Yes | Yes | |

| Roth IRAsinfo | Yes | Yes | |

| Advisor Servicesinfo | Yes | Yes | |

| International Countries (Stocks)info | 0 | 0 |

| Order Types | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Order Type - Marketinfo | Yes | Yes | |

| Order Type - Limitinfo | Yes | Yes | |

| Order Type - After Hoursinfo | Yes | No | |

| Order Type - Stopinfo | Yes | Yes | |

| Order Type - Trailing Stopinfo | Yes | No | |

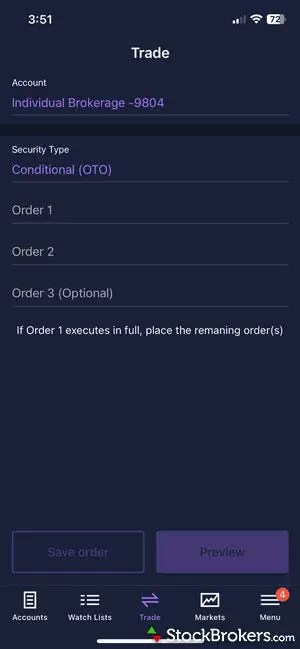

| Order Type - OCOinfo | Yes | No | |

| Order Type - OTOinfo | Yes | No | |

| Order Type - Broker Assistedinfo | Yes | Yes |

| Beginners | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Education (Stocks)info | Yes | Yes | |

| Education (ETFs)info | Yes | Yes | |

| Education (Options)info | Yes | Yes | |

| Education (Mutual Funds)info | Yes | Yes | |

| Education (Bonds)info | Yes | Yes | |

| Education (Retirement)info | Yes | Yes | |

| Retirement Calculatorinfo | Yes | Yes | |

| Investor Dictionaryinfo | Yes | No | |

| Paper Tradinginfo | Yes | No | |

| Videosinfo | Yes | Yes | |

| Webinarsinfo | Yes | Yes | |

| Webinars (Archived)info | Yes | No | |

| Progress Trackinginfo | No | No | |

| Interactive Learning - Quizzesinfo | No | No |

| Stock Trading Apps | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| iPhone Appinfo | Yes | Yes | |

| Android Appinfo | Yes | Yes | |

| Apple Watch Appinfo | Yes | No | |

| Trading - Stocksinfo | Yes | Yes | |

| Trading - After-Hoursinfo | Yes | No | |

| Trading - Simple Optionsinfo | Yes | Yes | |

| Trading - Complex Optionsinfo | Yes | No | |

| Order Ticket RT Quotesinfo | Yes | Yes | |

| Order Ticket SRT Quotesinfo | Yes | No |

| Stock App Features | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Market Movers (Top Gainers)info | Yes | Yes | |

| Stream Live TVinfo | Yes | No | |

| Videos on Demandinfo | No | No | |

| Stock Alertsinfo | Yes | No | |

| Option Chains Viewableinfo | Yes | Yes | |

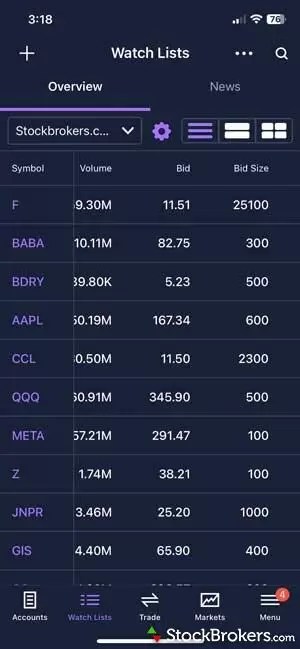

| Watch List (Real-time)info | Yes | Yes | |

| Watch List (Streaming)info | Yes | No | |

| Watch Lists - Create & Manageinfo | Yes | Yes | |

| Watch Lists - Column Customizationinfo | Yes | Yes | |

| Watch Lists - Total Fieldsinfo | 43 | 4 |

| Stock App Charting | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Charting - After-Hoursinfo | Yes | No | |

| Charting - Can Turn Horizontallyinfo | Yes | No | |

| Charting - Multiple Time Framesinfo | Yes | Yes | |

| Charting - Technical Studiesinfo | 107 | 36 | |

| Charting - Study Customizationsinfo | Yes | Yes | |

| Charting - Stock Comparisonsinfo | Yes | No |

| Trading Platforms | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Active Trading Platforminfo | Power E*TRADE | No | |

| Desktop Trading Platforminfo | No | No | |

| Desktop Platform (Mac)info | No | No | |

| Web Trading Platforminfo | Yes | Yes | |

| Paper Tradinginfo | Yes | No | |

| Trade Journalinfo | No | No | |

| Watch Lists - Total Fieldsinfo | 43 | 4 |

| Stock Chart Features | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Charting - Adjust Trades on Chartinfo | Yes | No | |

| Charting - Indicators / Studiesinfo | 121 | 36 | |

| Charting - Drawing Toolsinfo | 37 | 10 | |

| Charting - Notesinfo | Yes | No | |

| Charting - Index Overlaysinfo | Yes | Yes | |

| Charting - Historical Tradesinfo | Yes | No | |

| Charting - Corporate Eventsinfo | Yes | Yes | |

| Charting - Custom Date Rangeinfo | Yes | No | |

| Charting - Custom Time Barsinfo | No | No | |

| Charting - Automated Analysisinfo | Yes | No | |

| Charting - Save Profilesinfo | Yes | No | |

| Trade Ideas - Technical Analysisinfo | Yes | No | |

| Charting - Study Customizationsinfo | 8 | 3 | |

| Charting - Custom Studiesinfo | No | No |

| Day Trading | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

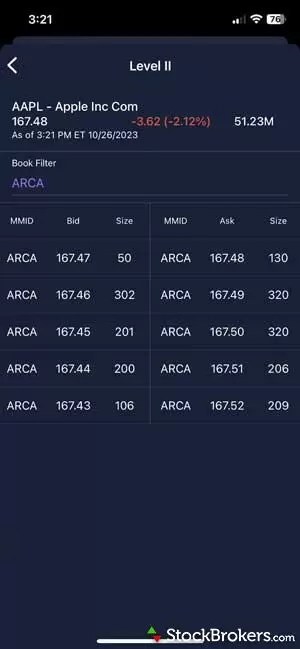

| Streaming Time & Salesinfo | Yes | No | |

| Streaming TVinfo | Yes | No | |

| Direct Market Routing - Stocksinfo | Yes | No | |

| Ladder Tradinginfo | No | No | |

| Trade Hot Keysinfo | Yes | No | |

| Level 2 Quotes - Stocksinfo | Yes info | No | |

| Trade Ideas - Backtestinginfo | No | No | |

| Trade Ideas - Backtesting Advinfo | No | No | |

| Short Locatorinfo | No | No | |

| Order Liquidity Rebatesinfo | No | No |

| Research Overview | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Research - Stocksinfo | Yes | Yes | |

| Research - ETFsinfo | Yes | Yes | |

| Research - Mutual Fundsinfo | Yes | Yes | |

| Research - Pink Sheets / OTCBBinfo | Yes | Yes | |

| Research - Bondsinfo | Yes | Yes | |

| Screener - Stocksinfo | Yes | Yes | |

| Screener - ETFsinfo | Yes | Yes | |

| Screener - Mutual Fundsinfo | Yes | Yes | |

| Screener - Bondsinfo | Yes | Yes | |

| Misc - Portfolio Allocationinfo | Yes | Yes |

| Stock Research | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Stock Research - PDF Reportsinfo | 8 | 2 | |

| Stock Research - Earningsinfo | Yes | Yes | |

| Stock Research - Insidersinfo | Yes | No | |

| Stock Research - Socialinfo | Yes | No | |

| Stock Research - Newsinfo | Yes | Yes | |

| Stock Research - ESGinfo | No | No | |

| Stock Research - SEC Filingsinfo | Yes | No |

| ETF Research | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| ETFs - Strategy Overviewinfo | Yes | Yes | |

| ETF Fund Facts - Inception Dateinfo | Yes | Yes | |

| ETF Fund Facts - Expense Ratioinfo | Yes | Yes | |

| ETF Fund Facts - Net Assetsinfo | Yes | Yes | |

| ETF Fund Facts - Total Holdingsinfo | Yes | Yes | |

| ETFs - Top 10 Holdingsinfo | Yes | Yes | |

| ETFs - Sector Exposureinfo | Yes | Yes | |

| ETFs - Risk Analysisinfo | Yes | No | |

| ETFs - Ratingsinfo | Yes | Yes | |

| ETFs - Morningstar StyleMapinfo | Yes | Yes | |

| ETFs - PDF Reportsinfo | Yes | No |

| Mutual Fund Research | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Mutual Funds - Strategy Overviewinfo | Yes | Yes | |

| Mutual Funds - Performance Chartinfo | No | Yes | |

| Mutual Funds - Performance Analysisinfo | Yes | Yes | |

| Mutual Funds - Prospectusinfo | Yes | No | |

| Mutual Funds - 3rd Party Ratingsinfo | Yes | Yes | |

| Mutual Funds - Fees Breakdowninfo | Yes | Yes | |

| Mutual Funds - Top 10 Holdingsinfo | Yes | Yes | |

| Mutual Funds - Asset Allocationinfo | Yes | Yes | |

| Mutual Funds - Sector Allocationinfo | Yes | Yes | |

| Mutual Funds - Country Allocationinfo | Yes | Yes | |

| Mutual Funds - StyleMapinfo | Yes | Yes |

| Options Trading | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

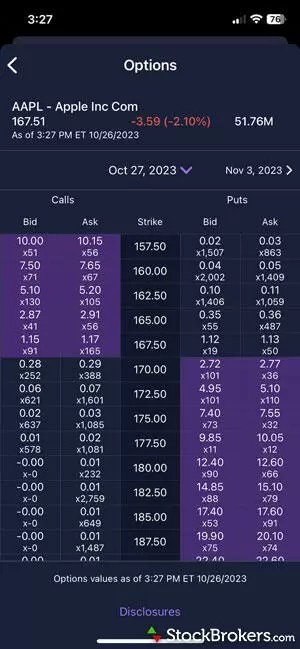

| Option Chains - Basic Viewinfo | Yes | Yes | |

| Option Chains - Strategy Viewinfo | Yes | No | |

| Option Chains - Streaminginfo | Yes | No | |

| Option Chains - Total Columnsinfo | 32 | 6 | |

| Option Chains - Greeksinfo | 5 | 0 | |

| Option Chains - Quick Analysisinfo | Yes | No | |

| Option Analysis - P&L Chartsinfo | Yes | No | |

| Option Probability Analysisinfo | Yes | No | |

| Option Probability Analysis Advinfo | Yes | No | |

| Option Positions - Greeksinfo | Yes | No | |

| Option Positions - Greeks Streaminginfo | Yes | No | |

| Option Positions - Adv Analysisinfo | Yes | No | |

| Option Positions - Rollinginfo | Yes | No | |

| Option Positions - Groupinginfo | Yes | No |

| Banking | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Bank (Member FDIC)info | Yes | Yes | |

| Checking Accountsinfo | Yes | Yes | |

| Savings Accountsinfo | Yes | Yes | |

| Credit Cardsinfo | Yes | Yes | |

| Debit Cardsinfo | Yes | Yes | |

| Mortgage Loansinfo | Yes | Yes |

| Customer Service | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Phone Support (Prospect Customers)info | Yes | No | |

| Phone Support (Current Customers)info | Yes | Yes | |

| Email Supportinfo | Yes | Yes | |

| Live Chat (Prospect Customers)info | No | No | |

| Live Chat (Current Customers)info | Yes | No | |

| 24/7 Supportinfo | Yes | Yes |

| Overall | E*TRADE | J.P. Morgan Self-Directed Investing | |

|---|---|---|---|

| Overall | |||

| Commissions & Fees | |||

| Investment Options | |||

| Platforms & Tools | |||

| Mobile Trading Apps | |||

| Research | |||

| Education | |||

| Ease Of Use | |||

| Winner | check_circle | ||

| Review | E*TRADE Review | J.P. Morgan Self-Directed Investing Review |

arrow_upward

E*TRADE vs J.P. Morgan Self-Directed Investing Comparison

Comparing brokers side by side is no easy task. We spend hundreds of hours each year testing the platforms, mobile apps, trading tools and general ease of use among online brokerages, as well as comparing commissions and fees, to find the best online broker.

Though many U.S. brokers offer basic trading features, such as an app, charting tools, stock research and educational content, the depth of those features can vary widely. Let's compare E*TRADE vs J.P. Morgan Self-Directed Investing.

Is E*TRADE or J.P. Morgan Self-Directed Investing better for beginners?

In stock trading, the more you know, the better you’ll do. Taking advantage of resources like articles, webinars, videos and interactive elements is a great way to shorten the learning curve. In our analysis, we examine the availability of several different types of educational materials.

For 2024, our review finds that E*TRADE offers more comprehensive new investor education for beginning investors than J.P. Morgan Self-Directed Investing. E*TRADE offers investors access to Paper Trading, Videos, Education (Stocks), Education (ETFs), Education (Options), Education (Mutual Funds), Education (Bonds) and Education (Retirement), while J.P. Morgan Self-Directed Investing offers investors access to Videos, Education (Stocks), Education (ETFs), Education (Options), Education (Mutual Funds), Education (Bonds) and Education (Retirement).

What about E*TRADE vs J.P. Morgan Self-Directed Investing pricing?

E*TRADE and J.P. Morgan Self-Directed Investing charge the same amount for regular stock trades, $0.00. E*TRADE and J.P. Morgan Self-Directed Investing both charge $0.65 per option contract. For futures, E*TRADE charges $1.50 per contract and J.P. Morgan Self-Directed Investing charges (Not offered) per contract. For a deeper dive, see our best brokers for free stock trading guide.

Does E*TRADE or J.P. Morgan Self-Directed Investing offer a wider range of investment options?

Looking at a full range of investment options, including order types and international trading, our research has found that E*TRADE offers a more comprehensive offering than J.P. Morgan Self-Directed Investing. E*TRADE ranks #4 out of 18 brokers for our Investment Options category, while J.P. Morgan Self-Directed Investing ranks #10.

E*TRADE offers investors access to Stock Trading, Options Trading, OTC Stocks, Mutual Funds, Futures Trading and Advisor Services, while J.P. Morgan Self-Directed Investing offers investors access to Stock Trading, Options Trading, OTC Stocks, Mutual Funds and Advisor Services. Neither have Fractional Shares and Forex Trading Looking at Mutual Funds, J.P. Morgan Self-Directed Investing trails E*TRADE in its offering of no transaction fee (NTF) mutual funds, with E*TRADE offering 4377 and J.P. Morgan Self-Directed Investing offering 3500.

Do E*TRADE and J.P. Morgan Self-Directed Investing offer cryptocurrency?

In our analysis of top U.S. brokerages, we research whether each broker offers the ability to trade cash cryptocurrency, such as bitcoin and ethereum. Though crypto has risen steadily in popularity, availability still varies from broker to broker. Our review finds that neither E*TRADE and J.P. Morgan Self-Directed Investing offer crypto trading.

Which trading platform is better: E*TRADE or J.P. Morgan Self-Directed Investing?

To compare the day trading platforms of E*TRADE and J.P. Morgan Self-Directed Investing, we focused on trading tools and functionality across both web and desktop-based platforms. Popular day trading platform tools include streaming real-time quotes, stock alerts, trading hotkeys, direct market routing, streaming time and sales, customizable watch lists, backtesting, and fully functional charting packages, among many others. For day trading, E*TRADE offers a better experience.

Does E*TRADE or J.P. Morgan Self-Directed Investing offer a better stock trading app?

After testing 25 features across the stock trading apps of E*TRADE and J.P. Morgan Self-Directed Investing, we found E*TRADE to be better overall. The best stock market apps are easy to use, have excellent design, and deliver a fully featured online trading experience. E*TRADE ranks #2 out of 18 brokers, while J.P. Morgan Self-Directed Investing ranks #12.

E*TRADE Trading App Gallery

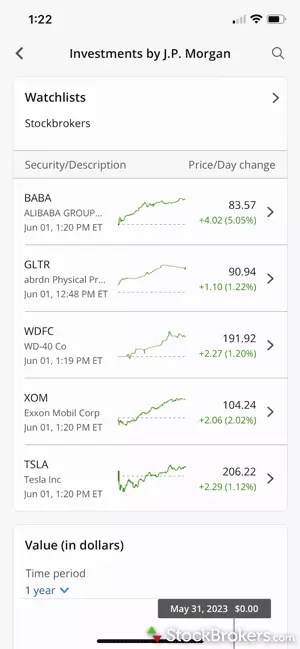

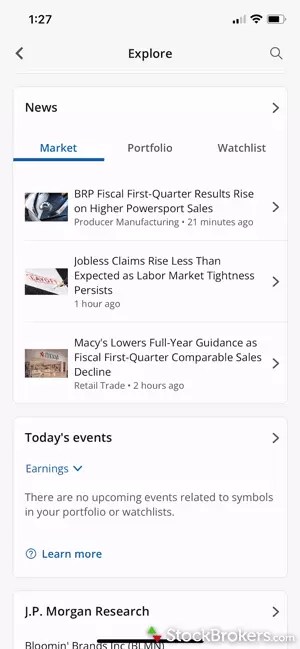

J.P. Morgan Self-Directed Investing Trading App Gallery

Which broker is better for researching stocks?

For research, E*TRADE offers superior market research than J.P. Morgan Self-Directed Investing. E*TRADE ranks #3 and J.P. Morgan Self-Directed Investing ranks #8.

Over the years, we've found that the best brokers provide rich market commentary, a variety of third-party research reports, and thorough quote screens that are not just easy to navigate, but that also include a comprehensive selection of fundamental data. Robust stock, ETFs, and mutual fund screeners are also must-haves for trade idea generation.

How do E*TRADE and J.P. Morgan Self-Directed Investing compare in terms of minimum deposit required?

E*TRADE requires a minimum deposit of $0.00, while J.P. Morgan Self-Directed Investing requires a minimum deposit of $0.00. From our testing, we found that SoFi is the only broker that requires a minimum deposit.

Which broker offers better margin rates for accounts under $25,000?

E*TRADE charges 14.2% for accounts under $25,000 while J.P. Morgan Self-Directed Investing charges a margin rate of 13.25%. The industry average of the 18 brokers we track is 9%.

Does E*TRADE offer fractional shares? Does J.P. Morgan Self-Directed Investing?

Fractional shares are not offered by either broker. Our research has found that 39% of brokers offer fractional shares investing. Fractional shares allow traders to buy a part of a whole share of stock. For example, if Amazon is trading at $1,000, you could buy half a share for $500.

Can you trade penny stocks with E*TRADE or J.P. Morgan Self-Directed Investing?

Both E*TRADE and J.P. Morgan Self-Directed Investing allow you to trade penny stocks. E*TRADE charges $6.95 per trade while J.P. Morgan Self-Directed Investing charges $0.00. Penny stocks are companies whose shares trade for under $5 and are listed over the counter (OTC). For brokers that do offer penny stock trades, the average commission is $3.

Does either broker offer banking?

Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Checking Accounts, Savings Accounts, Debit Cards, Credit Cards and Mortgage Loans are available to customers of E*TRADE and J.P. Morgan Self-Directed Investing.

Which broker offers stronger customer service?

StockBrokers.com partners with customer experience research group Confero to conduct phone tests from locations across the United States to thoroughly evaluate the quality and speed of brokerage customer service. (Read more about How We Test.) Here are the results of our current testing.

E*TRADE was rated 8th out of 13 brokers, with an overall score of 7.87 out of 10.

J.P. Morgan Self-Directed Investing could not be tested or rated due to the fact it does not offer phone support for prospective customers.

Is E*TRADE good?

E*TRADE is a top-performing broker whose highlights include $0 trades, two excellent mobile apps and the Power E*TRADE platform. Crypto, however, is not available.

In the 2024 StockBrokers.com Annual Awards, E*TRADE was ranked No. 1 for Investor App and Web Trading Platform. E*TRADE also placed among Best in Class for Commissions & Fees, Platforms & Tools, Research, Mobile Trading Apps, Investment Options, Education, Ease of Use, Bank Brokerage, Beginners, Futures Trading, IRA Accounts, Options Trading, Penny Stock Trading, High Net Worth Investors, and Overall.

Is J.P. Morgan Self-Directed Investing good?

J.P. Morgan Self-Directed Investing makes it easy for Chase Bank customers to invest and allows access to J.P. Morgan research. On the downside, the broker features are sparse compared to industry leaders.

In the 2024 StockBrokers.com Annual Awards, J.P. Morgan Self-Directed ranked No. 1 for New Tool and placed among Best in Class for Bank Brokerage.

E*TRADE vs J.P. Morgan Self-Directed Investing Winner

Overall winner: E*TRADE

Popular trading guides

- Best Futures Trading Platforms of 2024

- Best Brokers for Penny Stock Trading of 2024

- Best Trading Platforms for Stock Trading 2024

- Best Options Trading Platforms of 2024

- Best Day Trading Platforms of 2024

- Best Stock Trading Apps of 2024

- Best Trading Platforms for Beginners of 2024

More trading guides

Best Brokers for Free Stock Trading of 2024 Best Paper Trading Platforms of 2024 Best IRA Accounts of 2024 Best Online Brokers for Bitcoin Trading of 2024 Best Brokers for Order Execution of 2024 Best Brokers for Banking Services of 2024

Popular stock broker reviews

Ally Invest Review Charles Schwab Review Merrill Edge Review Interactive Brokers Review Tradier Brokerage Review Firstrade Review Tastytrade Review eToro Review SoFi Invest Review Vanguard Review Webull Review Fidelity Review TradeStation Review E*TRADE Review Robinhood Review J.P. Morgan Self-Directed Investing Review Public.com Review

More Comparisons

E*TRADE vs eToro E*TRADE vs tastytrade E*TRADE vs Citi Self Invest E*TRADE vs Fidelity E*TRADE vs Vanguard E*TRADE vs Firstrade J.P. Morgan Self-Directed Investing vs Robinhood J.P. Morgan Self-Directed Investing vs Merrill Edge J.P. Morgan Self-Directed Investing vs SoFi Invest J.P. Morgan Self-Directed Investing vs Tradier J.P. Morgan Self-Directed Investing vs eToro J.P. Morgan Self-Directed Investing vs Firstrade

Show all